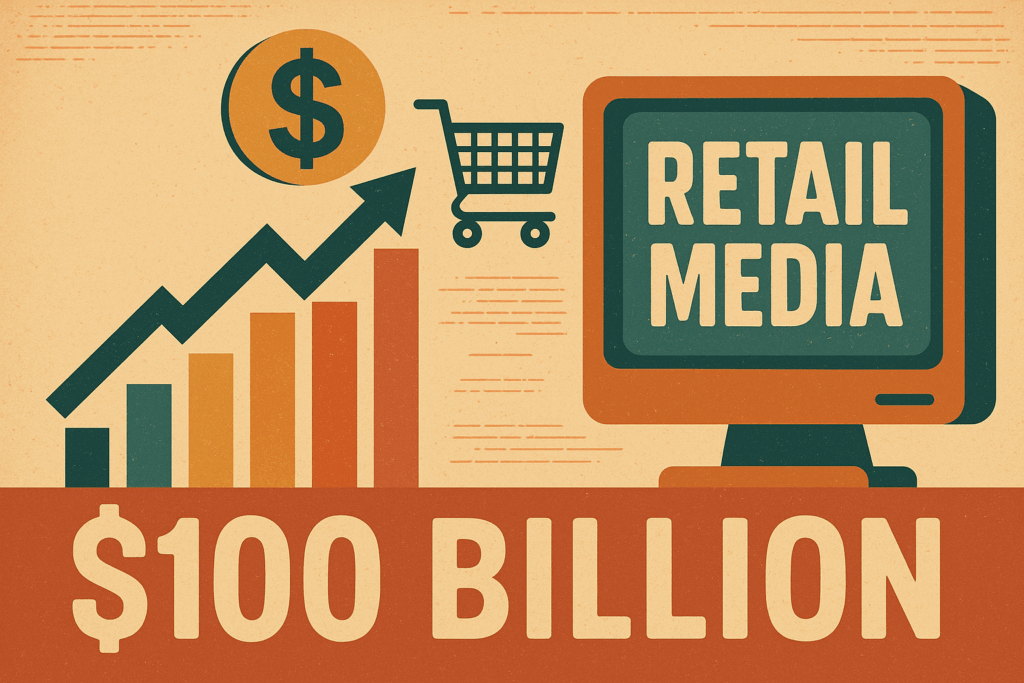

Mid-2025 – A Crucial Juncture for Retail Media

Retail media continues to grow rapidly, yet the landscape is shifting sharply. Retail Media Networks (RMNs) are moving from primarily on-site, conversion-focused advertising to adopting full-funnel strategies that encompass awareness through to purchase. This strategic evolution extends beyond retailer sites, incorporating programmatic channels, connected TV (CTV), and social platforms. The second half of 2025 presents a pivotal moment where RMNs must deliver clear value or face reductions in advertiser budgets.

The Full-Funnel Push and Measurement Imperative

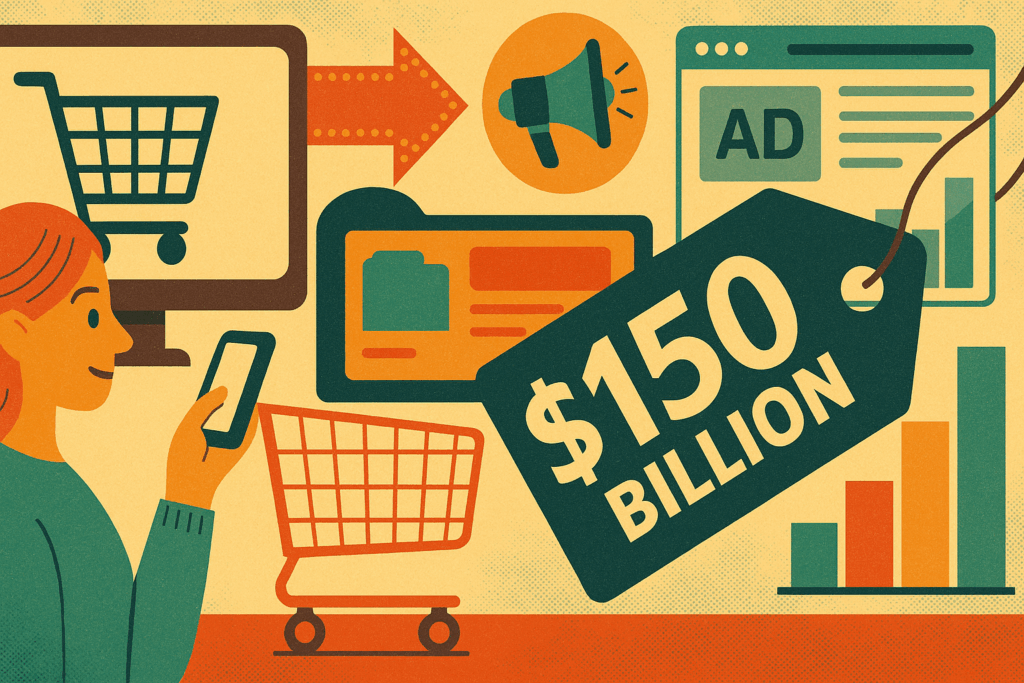

Advertisers now expect RMNs to support full-funnel campaigns that leverage first-party data to reach audiences at all stages. The demand stems from a need for scale, broader reach, and comprehensive, closed-loop measurement demonstrating impact from awareness through conversion. Major players like Amazon, with its Amazon Marketing Cloud (AMC), lead the industry in setting measurement standards that go beyond simple return on ad spend (ROAS). Other RMNs such as Walmart and Instacart are racing to implement similar capabilities. The result is a blurring of brand and performance budgets as RMNs offer unified solutions that bridge both marketing goals.

Beyond the Site: Off-Platform Expansion and Demonstrating Value

The growth of off-site retail media, including programmatic buying, CTV, and social channels, raises strategic and operational questions for both retailers and advertisers. Control over campaigns and ownership of strategy become key issues as budgets shift off the retailer’s domain. To encourage adoption, RMNs provide advanced measurement tools and incentives that track effectiveness beyond direct site interactions. However, advertisers exhibit “test and learn fatigue” as early experimentation phases conclude. RMNs are now required to prove measurable sales impact and broader business outcomes comparable to digital giants like Meta and Google.

The Road Ahead for Retail Media Networks

The stakes are high for RMNs in the latter half of 2025. Success depends on delivering sophisticated full-funnel approaches backed by robust attribution that verifies customer lifetime value, household penetration, and other advanced metrics. These networks must transition from pilot projects to consistently producing tangible, data-driven ROI. Advertisers’ willingness to continue allocating budgets hinges on RMNs’ ability to move past experimentation toward predictable performance and strategic integration within broader marketing ecosystems.

This moment marks a maturation point for retail media, where the capability to align with advertiser expectations will determine which RMNs secure sustainable growth and which face diminished influence.