Mastercard’s Entry Reshapes Retail Media

Unlocking Cross-Retailer Data Advantages

Mastercard’s launch of the Commerce Media Network signals a significant evolution in retail media. Unlike traditional retail media networks that operate within single retailers’ environments, payment processors such as Mastercard access expansive transaction data across multiple retailers. This cross-retailer visibility provides advertisers with more comprehensive insights into consumer purchasing behavior, enabling more precise targeting and measurement that individual retail networks can find difficult to replicate.

Implications for Existing Retail Media Networks

The entrance of Mastercard into the advertising space introduces new competitive pressures. Established retail media platforms, often reliant on first-party data from their own shopper ecosystems, now face a player aggregating anonymized spending data from various sources. This broader scope challenges existing networks to reconsider their data strategies, potentially driving increased collaboration or innovation to retain advertiser budgets. Retail media professionals must evaluate how their data assets compare to the unified transactional view payment processors offer and adapt to preserve relevance.

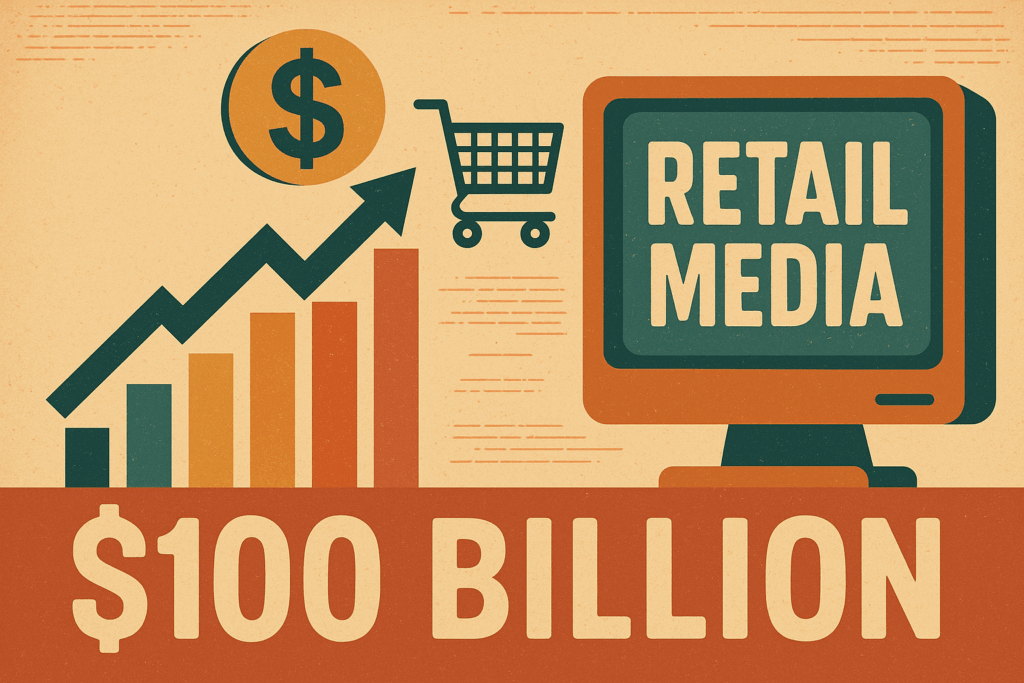

The Broader Trend: Payments Powering Ads

Mastercard is not alone. Other payment companies like PayPal and Stripe are also leveraging their transaction data to enter the advertising domain, making payments a new frontier for media and monetization. This trend underscores a shift where payment processors capitalize on their unique data position beyond mere transaction facilitation.

For retail media strategists, these developments emphasize the need to understand data access dynamics and competitive shifts. As payment processors expand their advertising capabilities, retail media networks must assess their differentiation, data partnerships, and first-party data activation approaches to sustain growth and advertiser interest.

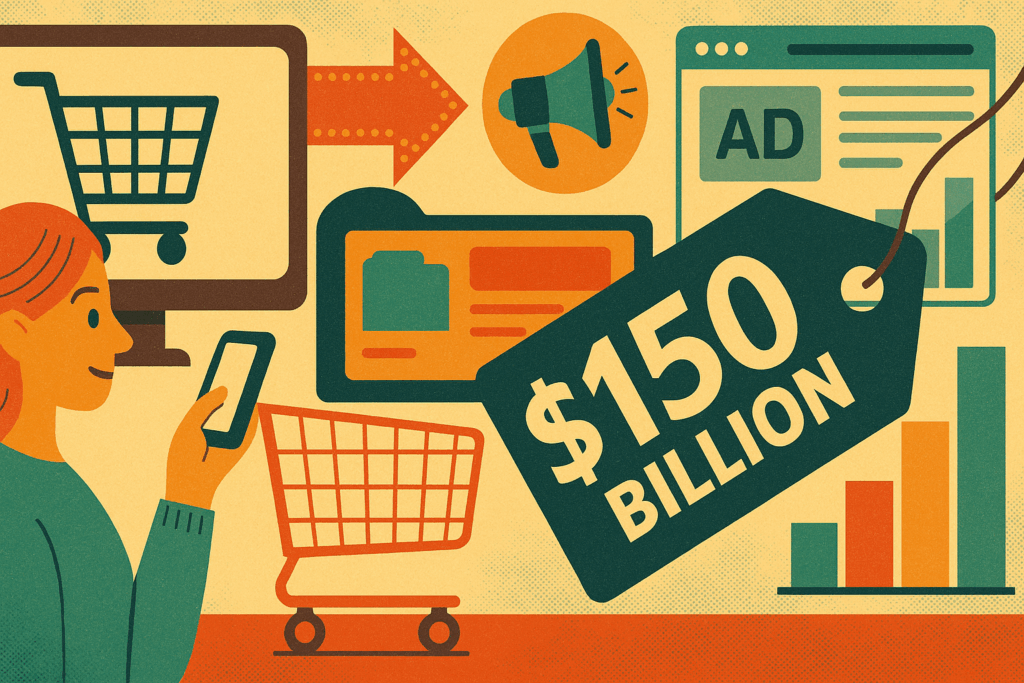

Amazon’s dominant ad revenue growth continues to set the benchmark for scale and data sophistication in retail media. However, the rise of payment processor media networks introduces an alternative model powered by cross-retailer transaction intelligence, reshaping how advertisers approach retail media investments and data innovation.

In conclusion, payment processors are emerging as influential players in retail media, offering expansive, cross-retailer data that challenges traditional single-retailer models. Staying informed about this evolving landscape is essential for retail media professionals aiming to maintain strategic advantage in data-driven advertising.